There’s enough drama in the housing industry at the moment, so why be misguided by silly homebuyer myths? As a prospective homeowner, you have more important things to focus on. Let’s dispel some all-too-common housing market myths.

⛔ I’ll Get a Better Deal Once Prices Crash ⛔

Unlikely…very unlikely. Lots of folks are sitting on the sidelines waiting for another 2008/2009-style housing crash, but today’s market could not be more different. In 2008, there was a dramatic oversupply of homes that exacerbated the crash. That’s just not the case today.

- Over 10 months of supply back in 2008, vs. around 4 months of supply now.

- 1.6 millions new homes available vs. roughly 1 million now.

- Foreclosures were rampant – around 1.7 million as compared to around 300,000 now.

Read more about the differences between the 2008 GFC and today’s housing market HERE.

⛔ I Won’t Be Able To Find Anything To Buy ⛔

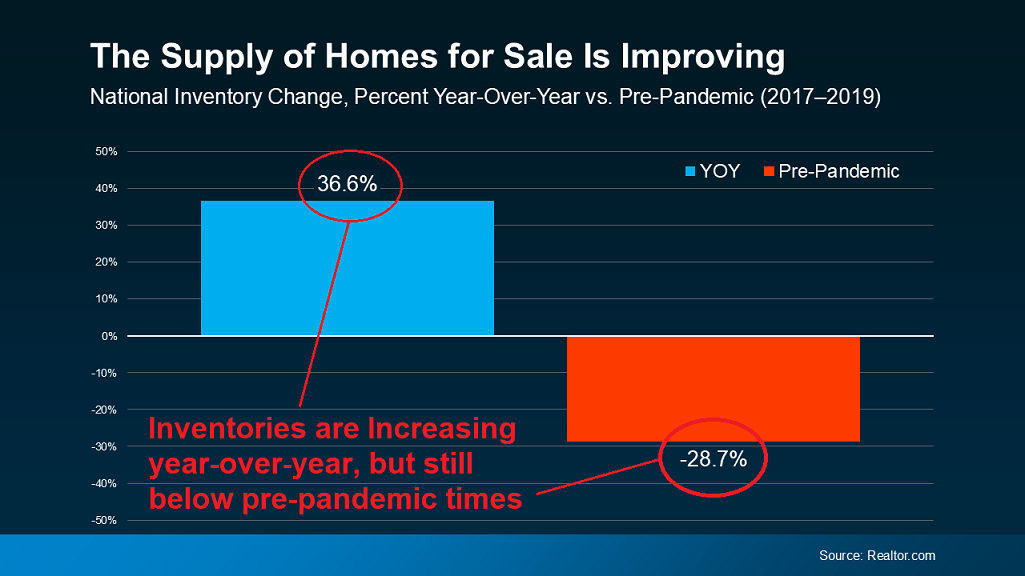

But wait…….housing inventory is increasing….A LOT! Throughout the year, the supply of homes for sale has grown. Data from Realtor.com helps put this into context. While there are still fewer homes on the market than in a more normal year like 2019, inventory is still above where it was at this time last year.

⛔ I Have To Wait Until I Have Enough for a 20% Down Payment ⛔

According to Fannie Mae “Approximately 90% of consumers overstate or don’t know the minimum required down payment for a typical mortgage.”

Did you know as a first time homebuyer, you can put down as little as 3% on a CONVENTIONAL mortgage loan? Data from the National Association of Realtors (NAR) shows the typical homeowner isn’t putting down as much as you might expect.

Ready to start your homeownership journey? At Lakeside Bank you have lots (I mean lots and lots) of options. And now that we’ve dispelled some housing market myths, let’s connect and get the process started!! Contact me at your convenience, even if it’s just to ask some questions. I’m ready when you are. 😊👍

Source: Today’s Biggest Housing Market Myths