As a mortgage loan consultant it’s virtually impossible to avoid fielding complaints about high mortgage interest rates 📈 and soaring 📈 home prices, especially with the Federal Reserve in an easing monetary policy stance. At times it feels like mortgage rates and home prices defy gravity, right? Well, let’s take a trip down memory lane to put things into perspective.

Below is a super cool chart from Leonard Kiefer – Deputy Chief Economist at Freddie Mac. It plots the weekly average 30yr mortgage rate from 1971 thru 11/27/2024 and it also displays the average by decade. With current 30yr rates hovering just below 7%, that puts us back around the averages of the 90’s and 2000’s, still well below the double-digit rates seen in the 1980’s, but obviously higher than the historic all-time lows seen during the pandemic.

Here are the 30yr mortgage rate averages by decade:

1970s — 8.90%

1980s — 12.71%

1990s — 8.12%

2000s — 6.29%

2010s — 4.09%

2020s (so far) — 4.95%

Where do we go from here? 🤷♂️

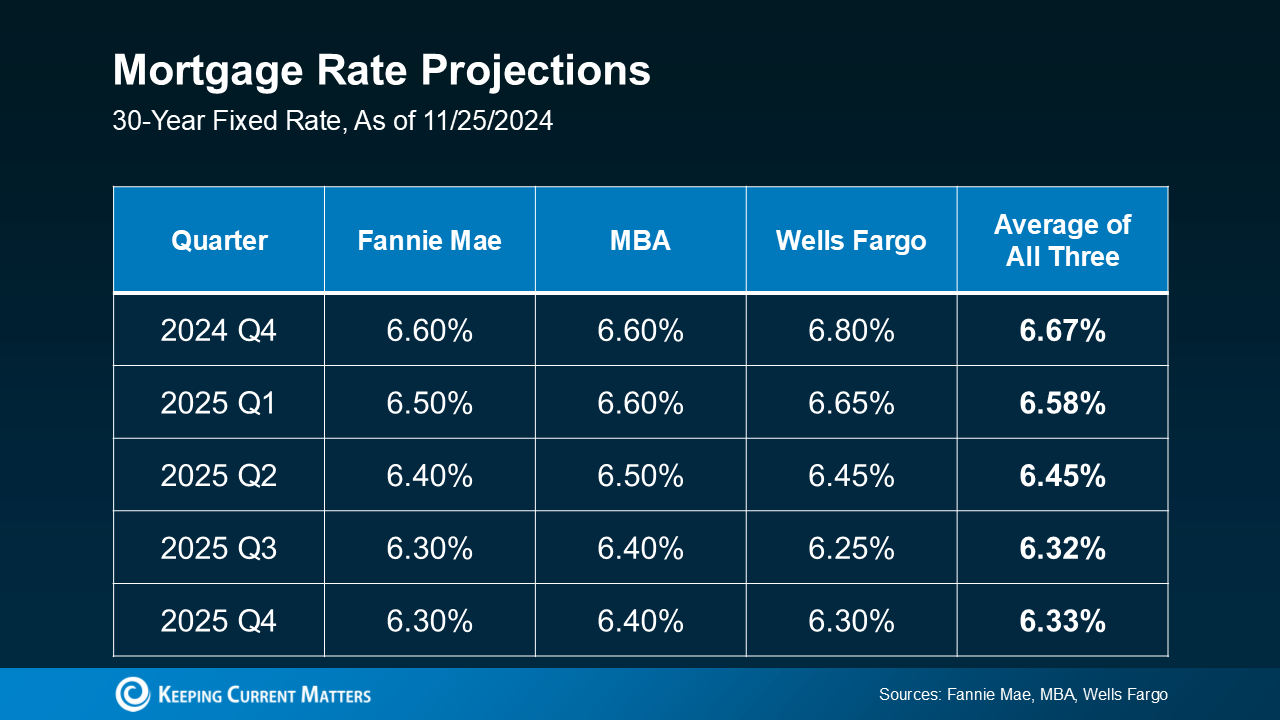

The consensus is looking for rates to stabilize in 2025 and all major think tanks predict rates in the 6s. Of course future news on Inflation, Employment and Government Policies will help to dictate the next major wave, but for now it’s expected that we trend sideways, with a slight bias towards lower rates.

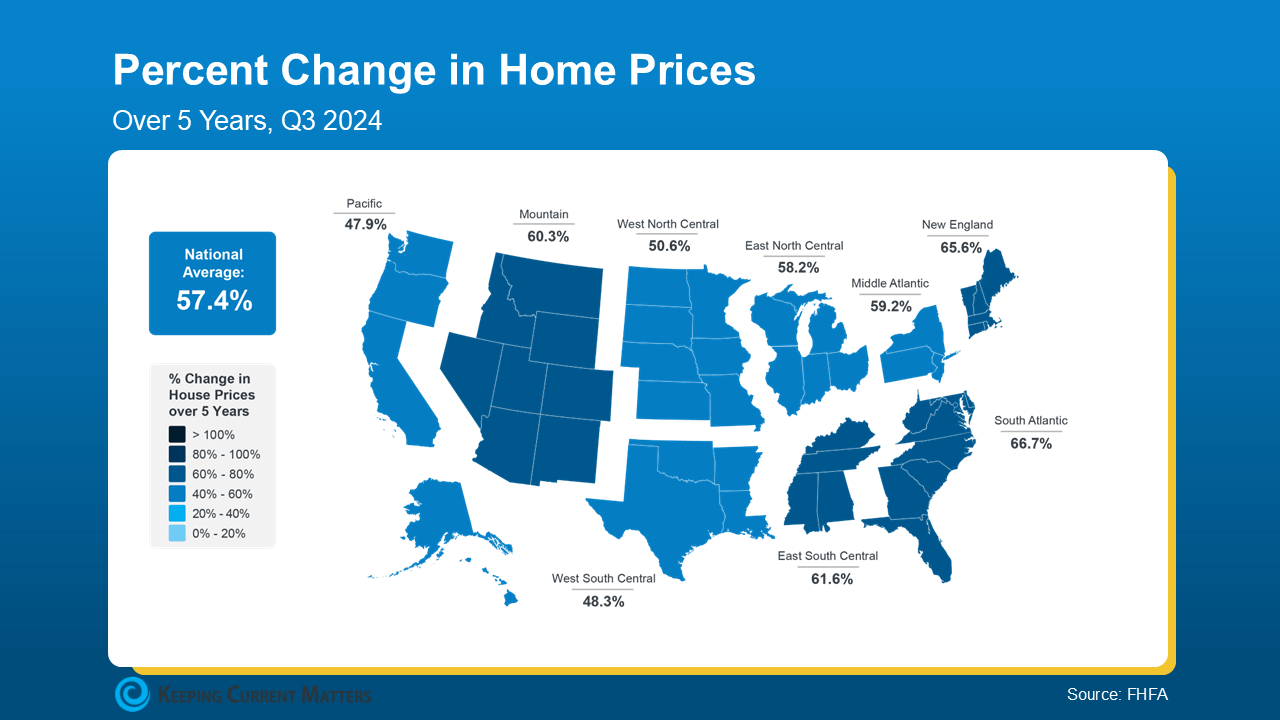

Now let’s look at 🏡 housing prices. Data from the FHFA (Federal Housing Finance Agency) Home Price Index is represented in the next two map illustrations – one showing the percent change in home prices over the last five years, and one showing the percent change in home prices since 1991. Since home prices vary by area, the map is broken out regionally to really showcase larger market trends. How did your regional market do?

Five years: The eastern seaboard is the clear winner.

Since 1991: Home prices appreciated by an average of more than 320% nationally.

In a 🥜 nutshell:

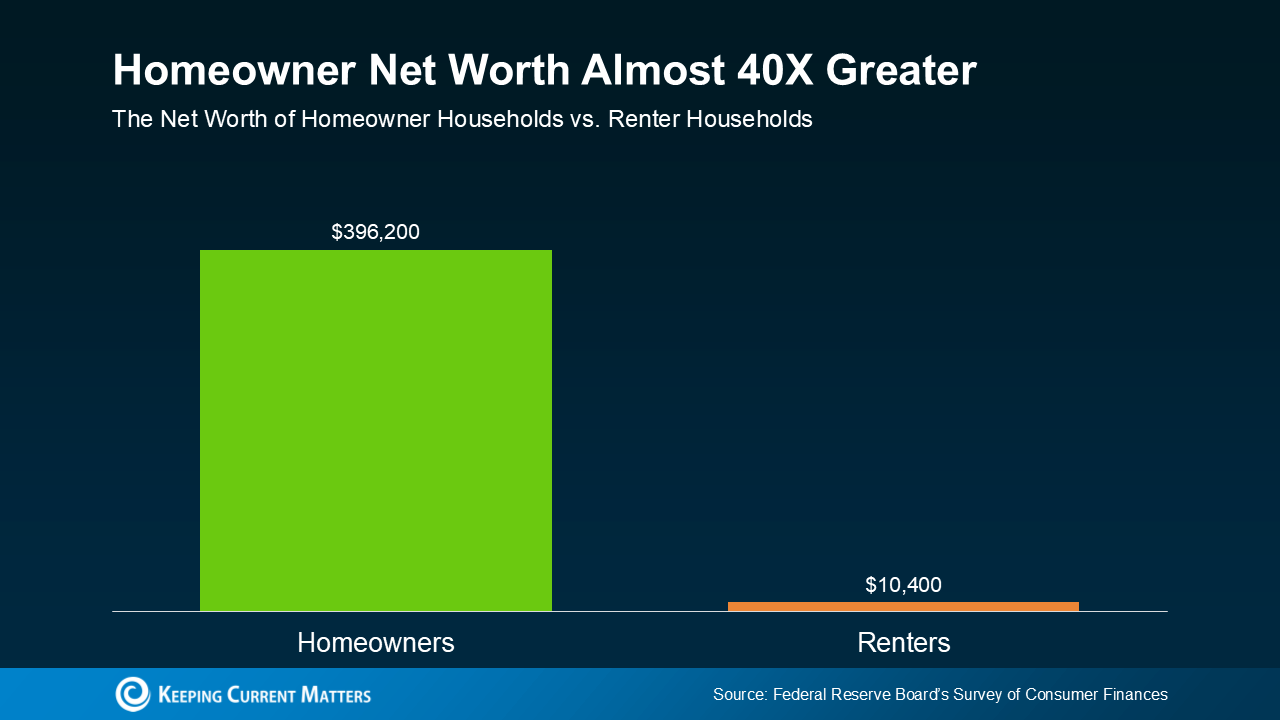

Today’s housing market is a bit dizzying, but history shows us that over the long haul, homeownership is an undeniable wealth builder. In fact, on average, a homeowner’s net worth is nearly 40 times higher than a renter’s. On that note, I’ll leave you with this 👇 chart. Please feel free to reach out with questions. 😊