If you’re currently shopping for a new home, you’re no stranger to the lock-in effect. This is quite likely the biggest reason for the overall lack of existing housing inventory and a very frustrating reality for today’s homebuyers. Let’s dive into the lock-in effect and how it’s reshaping today’s market.

The lock-in effect in real estate refers to the phenomenon where homeowners are reluctant or unable to sell their properties and move, often due to financial disincentives or unfavorable market conditions. The lock-in effect can reduce the overall mobility of homeowners, impacting the supply and demand dynamics in the real estate market and potentially contributing to housing shortages and affordability issues in certain areas. Several factors can contribute to this effect, including two key ones below:

Mortgage Rates: If a homeowner has a mortgage with a low interest rate and current rates are significantly higher, they may be unwilling to sell their home and take on a new mortgage at the higher rate, resulting in increased monthly payments.

Market Conditions: In a weak real estate market, homeowners may be unable to sell their homes for a price they consider acceptable. Conversely, in a strong market, they might struggle to find a new home that fits their needs and budget, especially if prices are rising rapidly.

Let’s take a look at Mortgage Rates first:

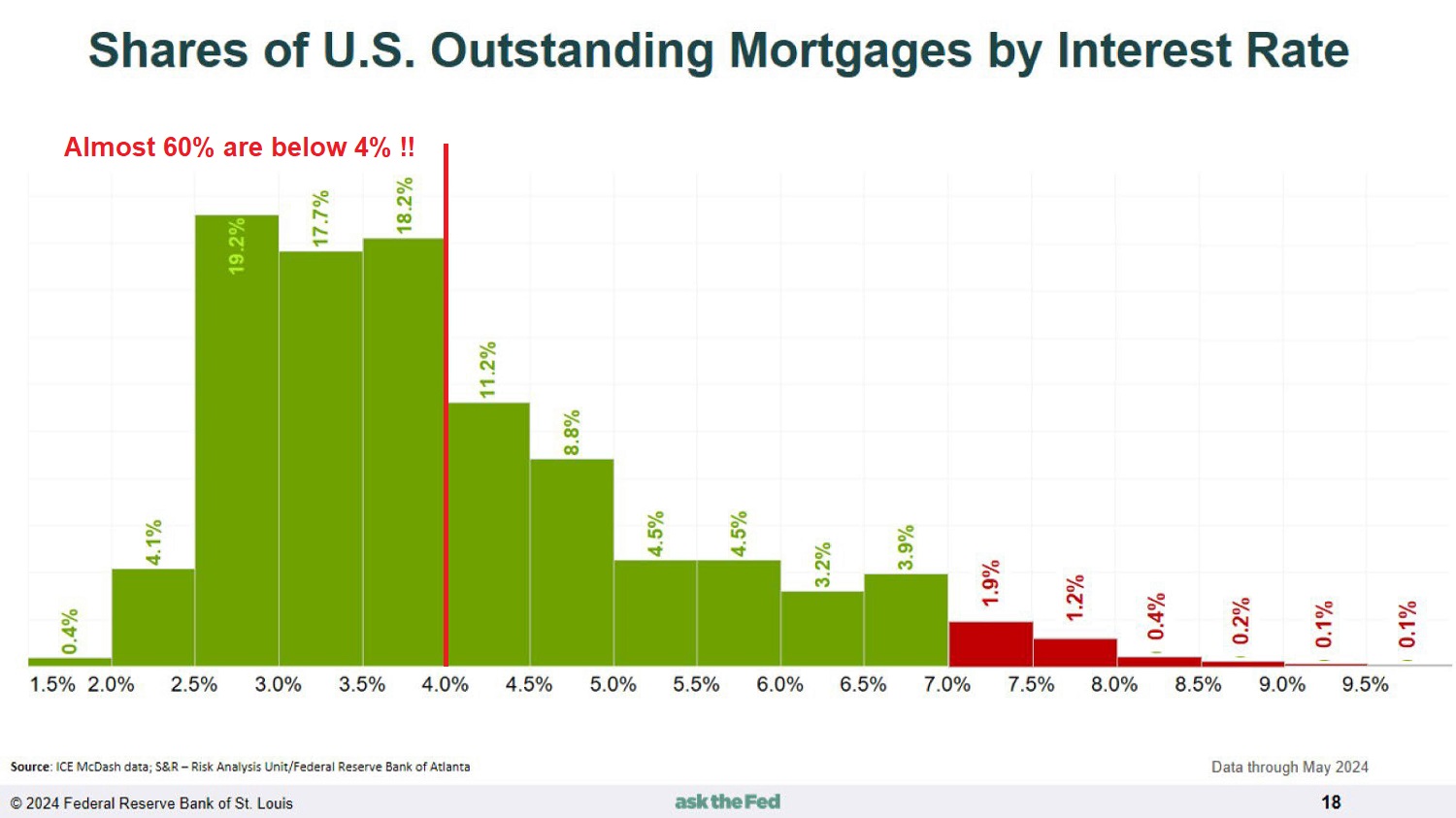

According to recent data published by the Federal Reserve Bank of St. Louis, a very large percentage of existing home mortgages have interest rates well below today’s average rates. In fact, almost 60% of outstanding mortgages have an interest rate below 4%.

With today’s average 30-year fixed mortgage rate hovering around 7%, that could equate to a much higher monthly payment when a homeowner sells a departing residence and trades up to what could be a 100% higher mortgage interest rate. To illustrate, let’s look at the monthly P&I (principal & interest) payment on a 3.5% existing mortgage vs. a 7% future mortgage on a typical median-priced single family home at $433,500. We’ll assume a down payment of 20% and a corresponding loan amount of $346,800. To make things easy, let’s also assume the existing loan balance on the departing residence is the same as the new home.

As you can see, on a median-priced home, the monthly payment based on today’s rates is nearly 50% more. Looking at the full life of the loans, the total interest paid is shockingly different. This is a very, very big reason why many current homeowners are staying put. But wait, there’s more.

Now let’s look at Market Conditions:

It’s no secret that home prices have shot up alarmingly fast since the global pandemic. Historically low intertest rates at the time and the heightened demand for detached single family housing drove prices into the stratosphere and sucked up the existing inventory faster than it could be replenished by new construction. Supply chain constraints and increasing building material costs made it impossible for housing developers to keep up with demand and offer anything remotely affordable. We still see signs of affordability challenges in new construction as the cost of development remains elevated during this period of high inflation.

So not only are interest rates higher, but the prices of homes are considerably higher as well and not showing any signs of receding. That double whammy exacerbates the lock-in effect. To be sure, the above contributes to a particularly difficult navigation process for first time homebuyers and many repeat homebuyers. However, it doesn’t take away from the long-term benefits of owning a home vs. renting a home. More on that later, in a more upbeat blog.

As always, I am available to field questions, discuss the markets, and help you navigate even the most challenging path to homeownership. Please feel free to reach out at your convenience. 😊